Follow Us

Tuesday, 22 August 2017

Saturday, 29 April 2017

Course details of Income Tax

Course title

|

Course type

|

Duration

|

Amount

|

Income Tax

|

Long

|

12 days

|

Tk.5,500.00

|

Income Tax

|

Short

|

7 days

|

Tk.3,500.00

|

Contents of Training:

Day-1:

- Basic concepts of public Finance

- Definition and classification of tax

- Canons of Taxation & Objective of taxation

- Historical background of Income Tax in Bangladesh

- Important Terms as defines in the income Tax Ordinance,1984

- Classification and Residential Status iof Assessee

- E- TIN

- Income tax Authority/Tax Administration

- Charge of Income tax, Surcharge

- Minimum Tax

- Total income: Scope and Computation

- Income deemed to accrue or arise in Bangladesh (s-18)

- Unexplained investments, etc, deemed to be income: S-19 (1) to 19 (31)

- Computation of taxable income from Salaries

- Computation of taxable income from Interest on Securities

- Computation of taxable income from House Property

- Computation of taxable income from agriculture

- Computation of taxable income from Business or profession

- Computation of taxable income from Capital Gain

- Computation of taxable income from Income from other sources

Day-2:

- Set off loses & carry forward of losses

- Exemption & allowances including tax holiday

- Exemptions of co-operative societies

- Advance Income Tax (AIT) and Tax Deductions at source (TDS)

- The consequences of AIT & TDS

- Consequences of non-payment of AIT and non-deduction of tax at source

- Income Tax Return

- Withholding Tax Return

- Return under section 108 of the ITO,1984

- Notices as per the ITO,1984

- Assessment: Section-81 to Section-94

- Assessment of Individual Assessee

- Assessment of a salaried person (Govt.)

- Assessment of a salaried person (Non-Govt.)

- Assessment of Firm

- Assessment of Company

Day-3:

- Tax Audit: Desk Audit and Field Audit

- How to face Audit of NBR

- How to face Central Intelligent Cell Officials?

- What is orthodox inspection?

- AG Audit

- Appeal, Tribunal & References

- Revision

- ADR

- Recovery of tax: Section-134 to Section -143

Day-4:

- Refunds: Section-146 to Section-152

- Penalties & Prosecutions

- Protection of information

- Avoidance of double taxation agreements

- Exclusion from total income (6th schedule part B)

- CST activities for corporate tax rebate

- Important Provisions of the Schedules of the ITO,1984

- A Practical/real case study

- Question & answers

Program Overview:

The

Institute of Professional Care of Bangladesh is the leading professional body

for Business Community as well as user of Taxation Laws. The Institute aims at

achieving a win- win situation for us and our trade where employers and /or

their employees as well as other stakeholders will be equipped with knowledge

and skills of taxation in order to ensure what to do them.

The

Institute of Professional Care of Bangladesh will make ready it’s trainees to

work for the future e-commerce environment and in order to do that it will

focus not only the Income Tax, Customs & VAT, Company law, Securities Law

to work in highly litigious corporate business environment. It has also a great

aim of setting a standard quality research Centre whose environment allows to

the young learners to involve in policy research on fiscal laws of Bangladesh.

Participants:

This

course has been specifically formulated for FCA, ACA, FCMA, ACMA, FCS, ACS,

Advocate, Income Tax Practitioner and Professional Students.

Benefits:

How Participants will benefit after

the course:

The purpose of this course is to provide the participants basic and structural knowledge regarding all aspects of Income tax. Thus after completion of the course, the participants would be able to:

- develop general & Professional knowledge regarding all aspects of Income tax;

- find solutions to many of their queries by themselves;

- Participants will be able to provide taxation services to their clients in effectively & efficiently.

The purpose of this course is to provide the participants basic and structural knowledge regarding all aspects of Income tax. Thus after completion of the course, the participants would be able to:

- develop general & Professional knowledge regarding all aspects of Income tax;

- find solutions to many of their queries by themselves;

- Participants will be able to provide taxation services to their clients in effectively & efficiently.

- Protect their organizations from many future troubles;

- further develop their career in taxation, finance and management.

- further develop their career in taxation, finance and management.

Road, Kakrail,Dhaka-1000

For Registration:

Please contact with: 01844146200,

01844146208, 9330258

E-mail:ipcb.bd@gmail.com.

Sunday, 23 April 2017

Thursday, 20 April 2017

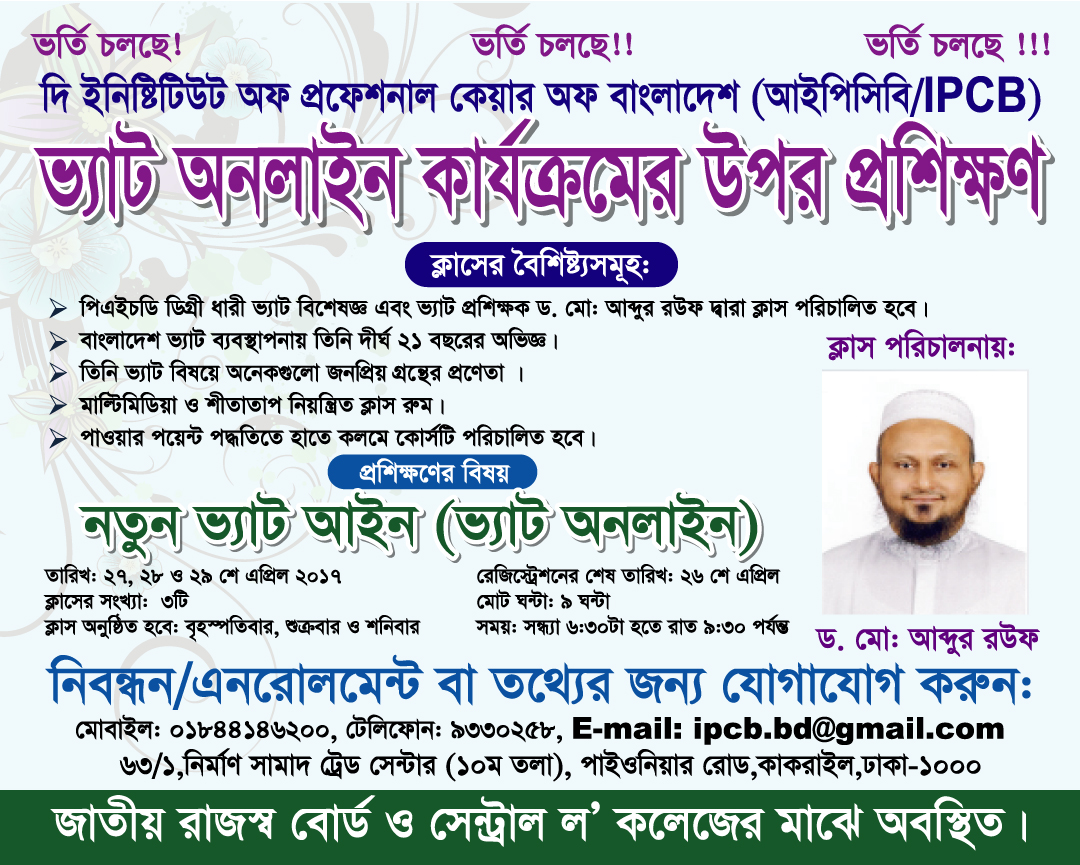

Three Days-Long Course on New VAT Law (VAT Online)

Three Days-Long

Course on New VAT Law

(VAT

Online)

Date: 27, 28

& 29 April,2017 Last date of Registration : 26 April 2017

No. of Classes Sessions: 3 Total

hour : 9 hours

Days: Thursday, Friday & Saturday Time:

6:30 to 9:30 pm

Venue: 63/1,Nirman Samad Trade Centre (9th

Floor), Registration fee: Tk.6,500.00

Pioneer Road, Kakrail,Dhaka

Resource

person

Dr. Md.

Abdur Rouf

Holding Ph.D in the area of VAT,

Dr. Rouf is a distinguished VAT expert of the country who has been working in

the VAT management of Bangladesh and providing VAT training for about 21

(Twenty one) years. Dr. Rouf is a widely acclaimed & renown VAT trainer of

Bangladesh.

Training Subject:

New

VAT Law (VAT Online)

For

registration/enrollment or additional information please contact with us at:

Cell:

01844146200 Tel: 9330258

E-mail: ipcb.bd@gmail.com

63/1,Nirman

Samad Trade Centre (9th Floor),Pioneer Road,Kakrail,Dhaka-1000

Sunday, 19 March 2017

Income Tax Practitioner (ITP) 5 days Course

দি ইনিষ্টিটিউট অফ প্রফেশনাল কেয়ার অফ বাংলাদেশ (আই পি সি বি)

ইনকামট্যাক্স প্র্যাকটিশনার (আই টি পি) -২০১৭ এর প্রস্তুতিমূলকপরীক্ষার্থীদের জন্য সীমিত আসনে ৩য় ব্যাচ এ ভর্তি চলছে।

ক্লাস শুরু ২১ শে মার্চ ২০১৭ মঙ্গলবার সন্ধ্যা ৬ টা হতে .........

ক্লাসের বৈশিষ্ট্যসমূহ:

- দীর্ঘ পেশাগত অভিজ্ঞ/এ্যাডভোকেটগন দ্বারা ইনিষ্টিটিউটের কোর্স পরিচালিত হয়।

- মাল্টিমিডিয়া ও শীতাতাপ নিয়ন্ত্রিত ক্লাসরুম।

- হ্যান্ডনোট প্রদান করা হয়।

- ক্লাসের পড়া ক্লাসেই সমাধান করা হয়।

- ডিজিটাল পদ্ধতিতে ক্লাসের ব্যবস্থা।

- ক্লাস শেষে মডেল টেষ্টের ব্যবস্থা ।

ভর্তি ইচ্ছুক ছাত্র-ছাত্রীগণ নিন্মোক্ত ঠিকানায় যোগাযোগ করার জন্য অনুরোধ করা হলো:

যোগাযোগের ঠিকানা:

নির্মান সামাদ ট্রেড সেন্টার (১০ম তলা),

৬৩/১, পাইওনিয়ার রোড,কাকরাইল,ঢাকা-১০০০,

মোবাইল নম্বর: 01844146200,01844146208

টেলিফোন: 9330258

ই-মেইল: ipcb.bd@gmail.com

জাতীয় রাজস্ব বোর্ড ও সেন্ট্রাল ল কলেজ এর নিকটে।

Tuesday, 28 February 2017

Income Tax Practitioner notice and form -2017

দি

ইনিষ্টিটিউট অফ প্রফেশনাল কেয়ার অফ বাংলাদেশ (আই পি সি বি)

আগামি ১০ই মার্চ ২০১৭, শুক্রবার থেকে

ইনকামট্যাক্স প্র্যাকটিশনার (আই টি পি) -২০১৭ এর

প্রস্তুতিমূলক

পরীক্ষার্থীদের

জন্য সীমিত আসনে ভর্তি চলছে।আই টি পি(ফরম)

আই টি পি (নোটিশ)

যোগাযোগের ঠিকানা:

63/1, Nirman Samad Trade Center (9th floor), Pioneer Road, Kakrail, Dhaka.

Mobile: 01844146200, 01844146208

E-mail:ipcb.bd@gmail.com

www.ipcbbd.blogspot.com

www.facebook.com/ipcb

Subscribe to:

Comments (Atom)